tax forgiveness credit pa

TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. PA - Special Tax Forgiveness Credit.

Most States To Treat Ppp Loan Forgiveness As Nontaxable Income

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA. We Help You Get Out of Debt Without Loans or Bankruptcy. However we also received 40k in Social.

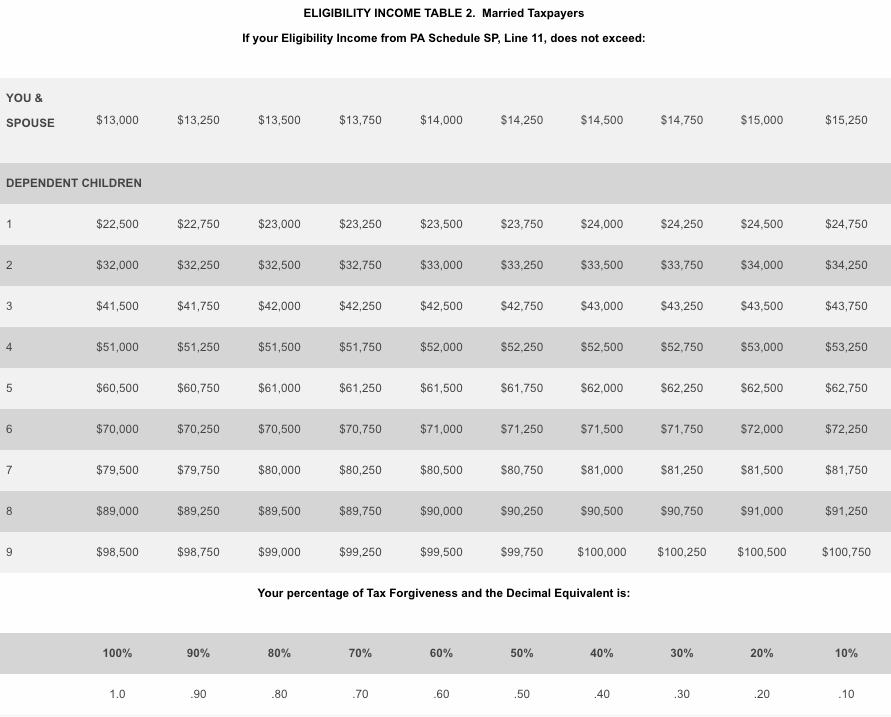

Move down the left-hand side of the table until you come to the number of dependent children you may claim. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. According to an analysis beneficiaries of President Bidens student loan forgiveness plan may have to pay taxes in 13.

The qualifications for the Tax Forgiveness Credit are as follows. Browse Our Collection and Pick the Best Offers. Insurance proceeds and inheritances- Include the total proceeds received from life or.

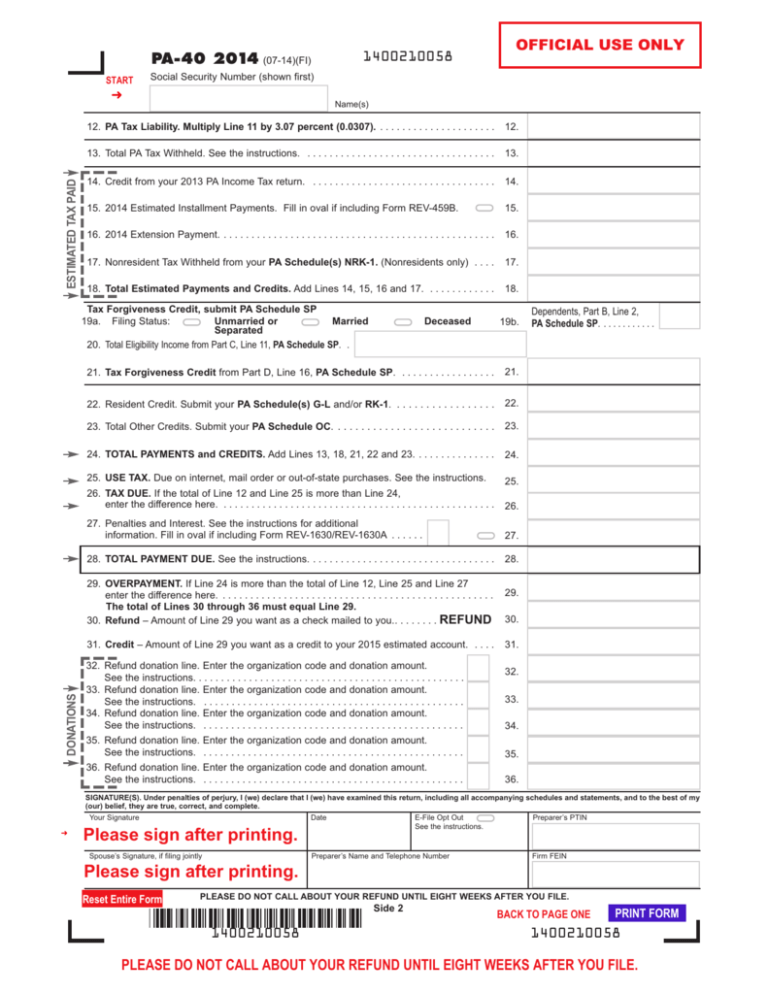

If you are filing as Married use Table 2. End Your Tax Nightmare Now. How to File a PA-40 and.

End Your Tax Nightmare Now. If you are filing as Unmarried use Table 1. What Is Tax Forgiveness In Pa.

Ad 5 Best Tax Relief Companies of 2022. Rated 1 Program by Top Consumer Reviews. Find Fresh Content Updated Daily For Pa state tax forgiveness.

Record tax paid to other states or countries. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

The PA earned income was 9100. Tax Forgiveness Credit Pa. A 2-parent family with two children and eligibility income of 32000 would qualify for 100 percent tax forgiveness.

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Record the your PA tax liability from Line 12 of your PA-40. You andor your spouse are liable for Pennsylvania tax on your income or.

Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax. Check Out the Latest Info. Ad 25000 Client Reviews.

For more information visit the Internal Revenue Services Web site. In Part D calculate the amount of your Tax Forgiveness. The departments instructions allow dependent children to claim tax forgiveness because as the 1974 law identifies the intent of the General Assembly as described above.

Solved Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. You are subject to Pennsylvania personal income tax. What is a Pennsylvania tax forgiveness credit.

If you live in PA and open a non-PA ABLE account you may miss out on important benefits. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax. Biden announced on Wednesday that the federal government would forgive up to 10000 in student loans for individuals making less than 125000 per year and up to 20000.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. The Mixed-Use Development Tax Credit program administered by the Pennsylvania Housing Finance Agency authorizes the Agency to sell 45 million of state tax credits to qualified.

Because eligibility income is different from taxable income. Ad 5 Best Tax Relief Companies of 2022. Ad Tax forgiveness credit pa.

Get a Free Consultation. Refunds available through the Tax Forgiveness program can be upwards of 1000 and depend on income and the number of dependent children. Lower Your Credit Card Payments.

New Yorkers face a likely maximum liability of 685. To enter this credit within. Where do I enter this in the program.

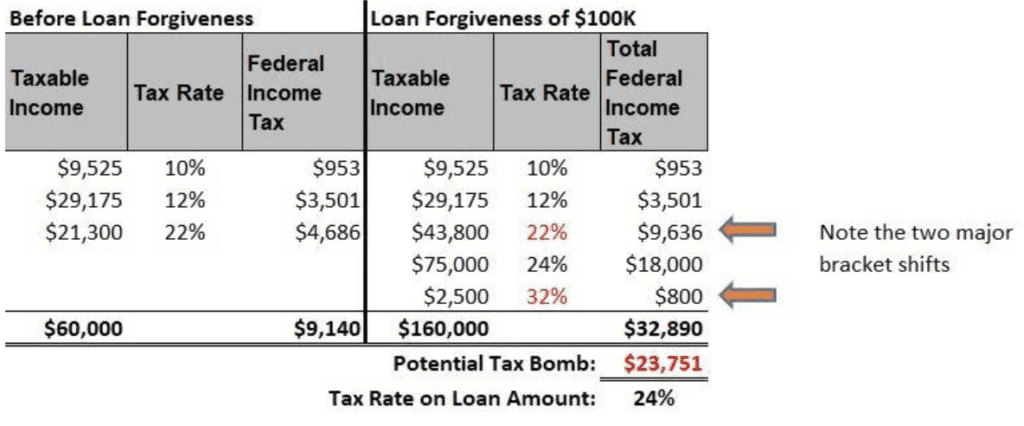

3 Months Ago Pennsylvania. The Tax Foundation estimates that borrowers could incur anywhere from 300 to over 1000 in state taxes depending on the specific state if they receive 10000 in student. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income.

To claim this credit it is necessary that a taxpayer file a PA-40. I think my client qualifies for the PA special tax forgiveness credit but Schedule SP is not being produced.

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

Taxes And Student Loan Forgiveness Updated 2021

/cloudfront-us-east-1.images.arcpublishing.com/pmn/YFKSL2Y3DBERHLKNUF3DQDJXOU.jpg)

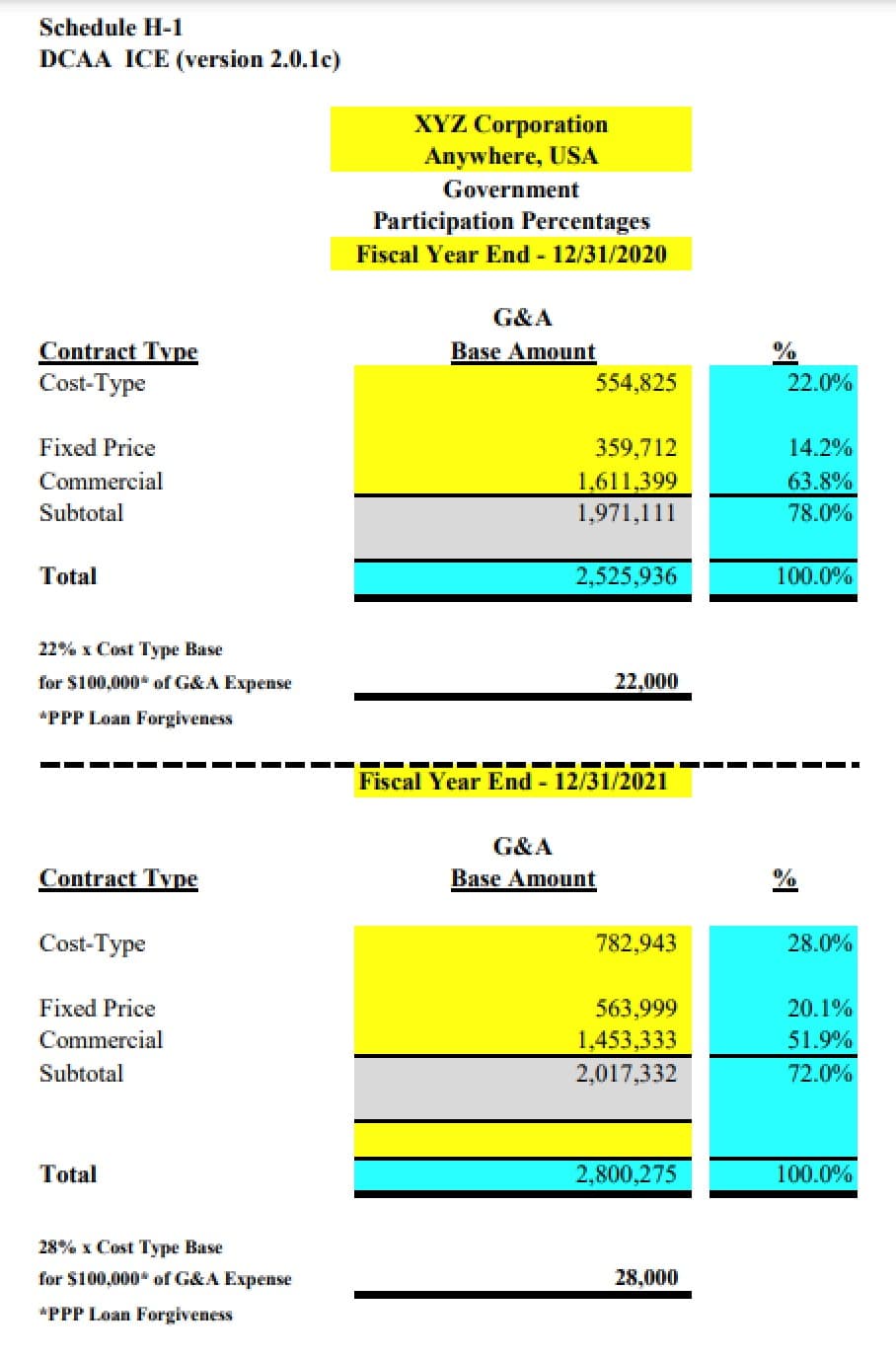

For Ppp Loans Small Business Owners Should Stop And Think Before Seeking Forgiveness

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy Visual Ly Chapter 13 Bankruptcy Bankruptcy Quotes

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

What Does The Cares Act Mean For Pslf Borrowers Future Proof M D The Borrowers Public Service Loan Forgiveness Federal Student Loans

Installment Agreements Md Va Pa Strategic Tax Resolution Debt Relief Programs Debt Relief Credit Card Debt Relief

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Public Service Loan Forgiveness Do You Qualify For It Student Loan Hero

Can You Apply For Teacher Loan Forgiveness Twice No But Student Loan Hero

Rhode Island Ppp Loan Forgiveness Income Tax Assessments Marcum Llp Accountants And Advisors

Private Student Loan Forgiveness Alternatives Credible

2400 Update Two Major Raises For Social Security Ssi Ssdi Stimulus Pa In 2022 Stock Market Tax Refund Daily News

Ppp Loan Forgiveness And Far Credits For Government Contractors Grf Cpas Advisors